Hicks theory of trade cycle

Hicks in his book 'A contribution to the theory of the trade cycle' developed a theory of trade cycle on the basis of the principle of multiplier and accelerator interaction. According to Hicks, multiplier and accelerator are the two sides of the theory of trade cycle or business cycle.

Assumptions of Hicks theory of trade cycle

(i) The autonomous investment rises at a constant rate.

(ii) The Savings and investment Coefficient are disturbed over time.

(iii) Hicks assumes constant values for the multiplier and accelerator.

(iv) The economy can't expand beyond the full employment level of output.

(v) There is a time gap, that is induced investment in the current period is a function of change in output of the previous.

(vi) The average capital output ratio is greater than 1.

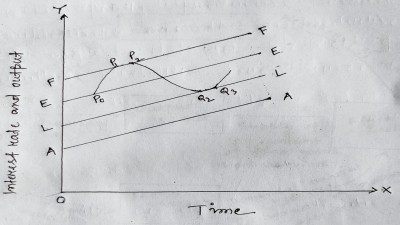

Hicks theory of Business Cycle has been explained with the help of following figure-

In the above figure, the line AA shows the path of autonomous investment growing at a constant rate and the line EE is the equilibrium level of output determined by autonomous Investment and the combined effect of multiplier accelerator interaction. Line FF is the full employment ceiling (upper limit) and LL is the lower equilibrium path of output representing the floor or slump equilibrium line. Hicks begins cycleness situation Po along with equilibrium path EE.

An increase in the rate of autonomous investment will lead to increase in income via multiplier accelerator interaction. As a result the economy moves from Po to Ps. Movement from Po to P¹ represents the upswing or expansion phase of the business cycle. Here the economy cannot move beyond P¹ because it hits the full employment ceiling line FF and the economy creeps along the ceiling line from P¹ to P² and thus the economy move along the celling line.

During the downswing, the multiplier investment mechanism sets in reverse, falling investment, reduced income and so on. The Downturm will start when there is fall in the Investment. When Investment Falls, income Falls via multiplier accelerator interaction. We know that when investment Falls multiplier works in the backward direction. As a result income level Falls and the economy moves downward from P² to Q².

Criticisms of Hicks theory of Trade cycle

(i) Hicks assume that the value of multiplier is constant. But in reality multiplier does not remain constant.

(ii) He also assumed that autonomous investment grows at a constant rate. But in actual practice during depression due to financial crisis autonomous investment Falls.

(iii) Hicks assume that there is a full employment ceiling and floor level. But in reality it is very difficult to determine the ceiling and floor level.

(iv) The entire Hicksian theory is based on complex mathematical framework. It is very difficult to understand.

Despite the above criticism, it is considered as the best explanation of the trade cycle. Hicksian theory of trade cycle is still considered as a superior theory to all the earlier theory.

2 Comments

Nice post

ReplyDeleteWonderful and helpful post

ReplyDeletePlease do not Enter any Spam link in the Comment box.