Case of Negative Externality

Negative externality emerges when one person's or groups action have some unfavorable impact on another party. For example- If a factory dumps the waste generated in his production activity in the nearby river, it may adversely effect other people who use the river water for their own purpose.

Negative externality is a cost that's suffered by the third party therefore of an economy transection. In a transection the producer and consumer are the first and second parties and third parties include any individuals, organizations, property owner or resource that is indirectly affected. The negative externality is also called external cost. Some externalities like waste arises from consumption or production. Like carbon amition from factories.

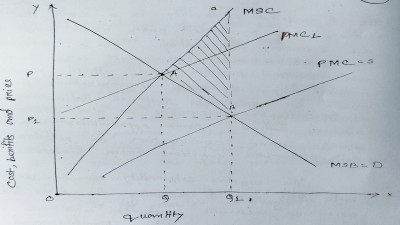

The negative externality can be explained with the help of following figure. Here on OX axis we measure quantity and on OY axis we measure cost, benefits and price MSC is Marginal Social Cost curve. MSB is Marginal Social Benefits curve. It is also called the demand curve. The Optimum level of output is determined by the equality of MSC=MSB.

Negative Externalit graph

In the above figure at point A we get MSC=MSB. Therefore OQ is the socially optimum level of output where there is no external effects. In this figure PMC is Private Marginal Cost curve which is also called supply curve. In the equilibrium market condition, equilibrium level of output is determined at point B where we get D=S. Here the competitive output level is OQ¹ which is greater than the Optimum level of output OQ. From the figure it is cleared that at OQ¹ level of output MSC>MSB. It means Q¹C - Q¹B= BC denotes the welfare loss or negative externality.

The negative externality can be removed with the help of pollution tax. If government imposes population tax per unit of output then Marginal Cost of production increases. As a result PMC curve shifts to the left to PMC¹ (PMC+Pollution tax). From the figure it is cleared that PMC¹ and MSB equal to each other at point A where we get socially optimum level of output OQ. At this level of output there is no external effects or cost. In this case we can remove negative externality.

0 Comments

Please do not Enter any Spam link in the Comment box.